Introduction

In both traditional finance and the rapidly evolving world of crypto, the term RWA stands for Real-World Assets. While the concept has long been a cornerstone of conventional finance, it has gained new significance with the rise of blockchain technology and tokenization. RWAs are physical or tangible assets that hold intrinsic value, such as real estate, commodities, or even invoices. In the context of crypto, RWAs are being brought on-chain, creating new opportunities for investment, liquidity, and financial inclusion.

RWA in traditional finance

In traditional finance, RWAs refer to assets that are not derivatives or financial products but have a tangible, physical existence or represent a legal claim on something of value. Examples include:

- Real estate: Properties, commercial buildings, or land.

- Commodities: Gold, oil, agricultural products.

- Equipment and machinery: Tangible goods used in production.

- Receivables: Unpaid invoices or loans that are expected to be repaid.

These assets form the backbone of many investment portfolios, providing stability and long-term value.

RWA in crypto and blockchain

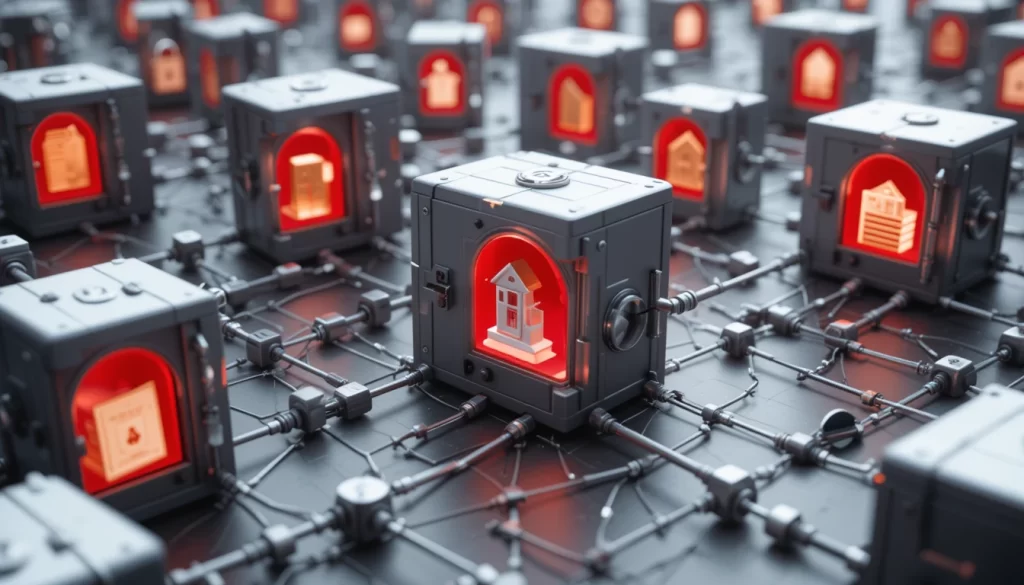

In the crypto world, RWAs represent the tokenization of real-world assets, bringing them onto the blockchain. This process involves creating digital tokens that represent ownership or a share of a physical asset. Tokenizing RWAs can unlock several benefits, such as increased liquidity, fractional ownership, and global accessibility.

Examples of tokenized RWAs include:

- Tokenized real estate: Platforms like RealT allow investors to purchase fractional ownership of properties via blockchain tokens.

- Tokenized commodities: Gold-backed tokens like PAXG represent physical gold stored in vaults.

- Tokenized art and collectibles: NFTs can represent ownership of physical artworks, with proof of authenticity recorded on the blockchain.

- Tokenized debt and bonds: Real-world debt instruments like government bonds or corporate debt can be issued as tokens, allowing for easier trading and settlement.

Why are RWAs important in crypto?

- Increased liquidity

Traditional RWAs, like real estate or art, are often illiquid, meaning they can’t be quickly sold or traded. Tokenization allows these assets to be easily traded on secondary markets, providing liquidity and making them more accessible to a wider range of investors. - Fractional ownership

Tokenization enables assets to be divided into smaller units, allowing more people to invest in assets that were previously out of reach. For example, you could own a fraction of a multi-million-dollar property or a piece of a rare artwork. - Global accessibility

By bringing RWAs onto the blockchain, investors from around the world can access opportunities that were once geographically limited. This opens up new markets and promotes financial inclusion. - Transparency and security

Blockchain technology ensures transparent and immutable records of ownership and transactions, reducing fraud and improving trust between parties.

Challenges of RWAs in crypto

While the potential of RWAs in the crypto space is enormous, there are still challenges to be addressed:

- Regulatory hurdles: Navigating the legal complexities of tokenizing real-world assets can be difficult, as different jurisdictions have varying rules.

- Valuation and verification: Ensuring the accurate valuation of physical assets and verifying ownership can be complicated.

- Technical integration: Bridging the gap between the physical and digital worlds requires robust infrastructure and partnerships with trusted custodians.

Conclusion

RWA, or Real-World Assets, are foundational to both traditional finance and the emerging world of blockchain. In the crypto space, tokenizing RWAs holds the promise of revolutionizing how we invest, trade, and interact with physical assets. By increasing liquidity, enabling fractional ownership, and fostering global accessibility, RWAs have the potential to reshape finance as we know it.

However, realizing this potential requires overcoming regulatory, technical, and logistical challenges. As the industry matures, RWAs will likely play a central role in the future of decentralized finance (DeFi), bridging the gap between traditional and digital economies.