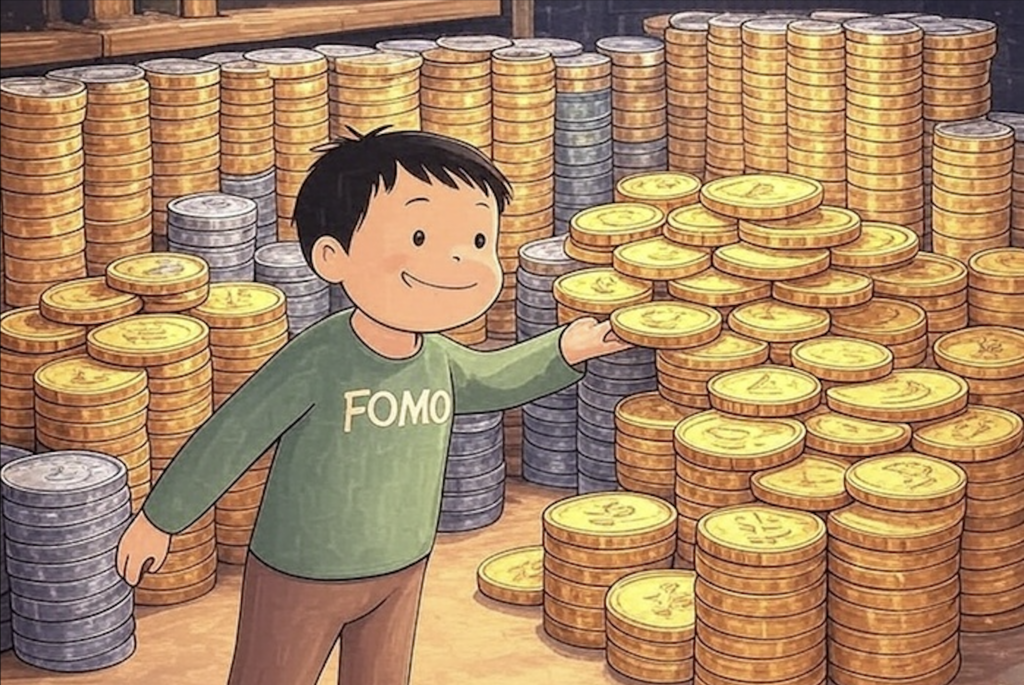

FOMO, or Fear of Missing Out, is a term you’ve probably heard thrown around in the crypto world, but what does it really mean? At its core, FOMO in crypto is the gut-wrenching anxiety that you’re missing out on a massive opportunity—like a token’s price shooting to the moon while you’re stuck on the sidelines. It’s that urge to jump into a trade because everyone else seems to be making a fortune, often driven by hype, price surges, or social media buzz. But as I learned the hard way, FOMO can be a double-edged sword, leading to impulsive decisions that don’t always pay off. Let’s unpack what FOMO is, why it happens, and what it means for crypto traders.

The Psychology of FOMO

FOMO is all about emotion. It’s the fear that if you don’t act now, you’ll miss out on life-changing gains. Picture this: a token starts climbing fast, and suddenly your X feed is flooded with posts about people making 500% returns overnight. You feel a mix of jealousy and panic—like you’re being left behind while others cash in. That’s FOMO in action. Studies show it’s a real psychological driver—70% of crypto investors say they’ve felt it, often because they’re comparing themselves to others’ success. It’s not just about the money; it’s the fear of regret, of watching others win while you sit out.

What Fuels FOMO in Crypto?

Crypto markets are a perfect breeding ground for FOMO. First, there’s the volatility—prices can skyrocket in hours, creating a sense of urgency. Take Dogecoin in 2021: it surged 8,000% in a few months, largely because of Elon Musk’s tweets, and people rushed in, terrified of missing the ride. Then there’s social media—X is a FOMO machine, with influencers hyping up the “next big thing” and viral posts showing off gains. Add in bull runs, where everything seems to be going up, and it’s easy to feel like you’re the only one not in on the action. Even celebrity moves, like Eminem buying a Bored Ape NFT, can spark FOMO, making you think you need to jump on the bandwagon.

My FOMO Journey: A Cautionary Tale

I’ve been there, and it wasn’t pretty. At the peak of my crypto trading in 2021, FOMO had me in a chokehold. I’d see tokens like SHIB or Dogecoin rocketing up, and I’d feel this physical urge to buy in—a knot in my stomach, almost jealous of others making profits. I was so eager to join the hype, scrolling X for hours, watching influencers rave about the next “moon coin.” I’d jump in without research, buying into the buzz, thinking I’d miss out on the next big thing. Most of the time, it didn’t work out well—I’d buy at the peak, only to watch the price crash days later. I lost a fair bit of money, but the real kicker was the stress. I’d lie awake, second-guessing every move, feeling like I’d let a golden chance slip away. It taught me a hard lesson: FOMO can cloud your judgement and hit you where it hurts—your wallet and your peace of mind.

The Impact of FOMO on the Crypto Market

FOMO doesn’t just mess with your head—it shapes the market too. On the downside, it can inflate bubbles. When everyone piles into a token out of FOMO, prices soar beyond their real value. SHIB in late 2021 is a classic example—FOMO drove its market cap to £40 billion, but it crashed 70% soon after as buyers sold off. That kind of volatility can burn latecomers, with surveys showing 65% of FOMO-driven investors lose money. It also fuels scams, like pump-and-dump schemes, where hype lures people in only for the price to tank.

But there’s a flip side. FOMO can drive adoption, pulling new people into crypto. The 2021 bull run, where Coinbase saw a 60% user spike, was partly FOMO-fueled—people didn’t want to miss out on the action. It can also spotlight new projects, sparking innovation, even if some of those projects don’t last. The catch is balancing that excitement with caution, because FOMO often leads to more losers than winners.

Navigating FOMO in Crypto

So, what can you do about FOMO? My experience taught me a few things. First, slow down—don’t let the hype push you into rash trades. Research the project, check its fundamentals, and set a strategy. Second, tune out the noise—X can be a FOMO amplifier, so take breaks from the hype. And finally, remember that there’s always another opportunity in crypto. Missing one rocket ship doesn’t mean you’ve missed the whole journey. FOMO is a powerful force, but it doesn’t have to control you—it’s about learning to trade with your head, not your heart.